Starting a business is like planting a tree—you need the right soil (idea), sunlight (timing), and water (funding). But what if you decide to grow your tree without external water, relying solely on what you can provide yourself?

That, in business terms, is bootstrapping. It’s when an entrepreneur funds a startup using personal savings, revenue from early sales, or internal cash flow rather than seeking outside investment.

Bootstrapping has become a badge of honor in the startup world. Many successful businesses like Mailchimp, Spanx, and GoPro started this way.

But as liberating as it sounds, it’s not without its potholes.

In this article, we’ll take a deep dive into the benefits and drawbacks of bootstrapping your business, peppered with real-world statistics, to help you make an informed decision.

1. Financial Independence and Full Ownership

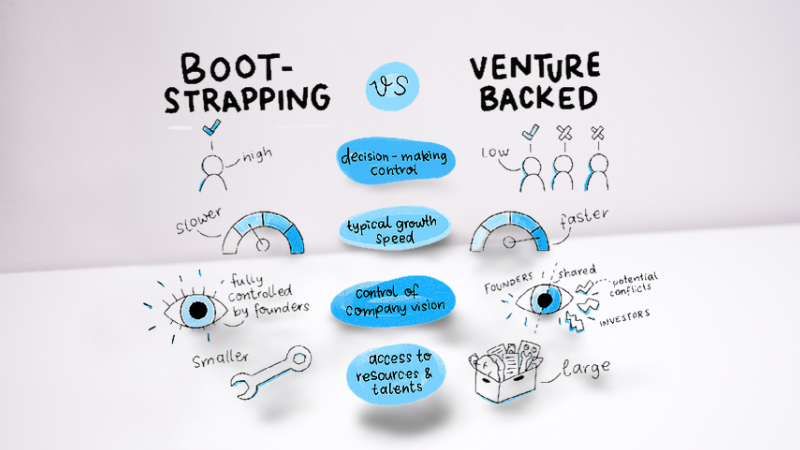

When you bootstrap, you own 100% of your business. You don’t answer to investors or share profits with external stakeholders.

This independence can be a powerful motivator.

According to a report by the Kauffman Foundation, 84% of startups are self-funded in their early stages, indicating a growing preference for maintaining control.

You decide the company’s direction, product features, hiring pace, and branding—without pitching every move to a board or angel investor.

However, owning it all also means bearing all the risk. If the business fails, your finances take the hit. There’s no investor safety net or financial cushion from a venture fund.

2. Discipline in Financial Management

One hidden gem of bootstrapping is that it forces entrepreneurs to become lean and financially disciplined. When you’re managing your own money, there’s no room for wasteful spending.

Take Mailchimp, for example. The founders never took outside funding. They reinvested every profit into the business and ended up selling it for $12 billion in 2021—100% of that went to them and their employees.

Bootstrapped businesses often become more customer-centric because they rely on revenue to survive.

This approach encourages rapid learning, better customer service, and value-oriented growth strategies.

However, the flipside is slower growth due to limited capital. What could be achieved in one year with funding might take three years when self-funded.

3. Agility and Faster Decision-Making

Without external investors, bootstrapped founders are free to pivot quickly when needed. This agility can be critical in fast-moving markets.

For instance, a study by the Global Entrepreneurship Monitor (GEM) showed that 45% of bootstrapped startups could pivot faster than VC-funded ones. That’s because there’s no red tape, no quarterly board meetings, and no approval chains.

Still, agility doesn’t always mean resilience. Bootstrapped businesses may lack the financial muscle to handle sudden market shocks, like a pandemic or economic downturn. Many solo entrepreneurs struggled during COVID-19, not because of poor business models, but due to limited liquidity.

4. Building a Strong Company Culture

Bootstrapping often means starting small—maybe just a co-founder, a laptop, and a rented desk. But this intimate setup encourages a tight-knit company culture from the beginning.

You’re hiring cautiously, ensuring every team member is a culture fit. You’re building something meaningful, not just chasing high valuations. Employees often feel more connected because they’re part of something genuine and scrappy.

However, if overdone, this “close-knit” nature can stifle diversity and innovation. Without the ability to hire experienced professionals quickly, bootstrapped founders might stretch themselves thin or build teams lacking fresh perspectives.

freepik

5. Customer-Funded Growth Builds Strong Market Fit

One of the smartest elements of bootstrapping is growing through customer revenue. When customers fund your growth, they validate your product or service.

This means you’re creating something people want—and are willing to pay for. According to a study by the Startup Genome Project, startups that rely on customers in early growth phases are 20% more likely to survive beyond five years.

But customer-funded growth often means saying no to risky innovation. You may not be able to fund a breakthrough product or expand to new markets because you’re tied to immediate revenue.

Also Read: 10 Ways to Manage Conflicts and Disagreements in a Business Team Without Losing Morale

6. Slower Scaling and Missed Opportunities

Here’s where bootstrapping hits its biggest wall—limited capital equals slower scaling.

You might have a great product and a hungry market, but without funds for marketing, expansion, or team building, growth may crawl. While funded startups can hire 10 sales reps, launch aggressive ad campaigns, and open new offices, bootstrapped ones often can’t afford those luxuries.

CB Insights reports that 29% of startups fail because they run out of cash, a risk much higher for bootstrapped businesses. Even if you’re making profits, growth might be inconsistent or too slow to compete.

7. Burnout and Personal Financial Risk

Bootstrapping can take a toll on your mental health and personal finances. You’re juggling roles: CEO, marketer, accountant, HR, and customer support.

A study by the University of California found that 72% of entrepreneurs suffer from mental health issues, with stress and burnout being top culprits. For bootstrappers, this stress is amplified by the uncertainty of income and the pressure of stretching every dollar.

Moreover, dipping into savings or taking out personal loans to fund your business can strain relationships and erode your safety net. It’s rewarding if you succeed, but crushing if things don’t go as planned.

8. Harder Access to Talent and Resources

Top talent often prefers funded startups because they offer higher salaries, better perks, and potential stock options. For a bootstrapped business, competing for such talent can be tough.

Additionally, a lack of funds can limit access to advanced tools, software, or consultants that could fast-track your business. You may have to rely on free trials, DIY marketing, or outdated tech—all of which can delay growth or impact efficiency.

9. Not All Industries Are Bootstrap-Friendly

Some industries are naturally more suited to bootstrapping. Service-based businesses, digital products, and online consulting typically have low startup costs.

But if you’re in manufacturing, hardware, biotech, or logistics, bootstrapping may not be realistic. These sectors often require heavy upfront capital for R&D, licensing, inventory, or machinery. In these cases, external funding may be the smarter move.

10. Proof of Grit and Long-Term Value

Finally, bootstrapping is a sign of resilience, grit, and long-term thinking. If you manage to grow and scale a company with minimal resources, it demonstrates incredible problem-solving skills and market understanding.

Interestingly, a 2023 report by Forbes indicated that bootstrapped companies are 30% more likely to be profitable within the first three years compared to VC-funded ones. That’s because they grow based on real demand, not inflated valuations.

And when bootstrapped businesses do seek funding later, they’re often in a stronger bargaining position, attracting better deals and retaining more control.

Final Verdict: Should You Bootstrap Your Business?

Bootstrapping isn’t for the faint of heart. It demands financial discipline, creativity, emotional resilience, and unwavering belief in your vision. If you’re launching a business that doesn’t need huge upfront capital, and you’re confident in your ability to manage resources, bootstrapping could be your best bet.

Also Read: 5 Untapped Business Opportunities in Nigeria That Will Soon Be in High Demand

But it’s essential to be honest about your needs and limitations. If access to talent, infrastructure, or quick scaling is crucial, then seeking external funding may give you the head start you need.

Bootstrap with Eyes Wide Open

Bootstrapping is like hiking up a mountain without a guide. The freedom is exhilarating, the pace is yours to set, and the view from the top—if you make it—is entirely yours. But the journey is longer, riskier, and often lonelier.

So, if you’re thinking of bootstrapping, do it with eyes wide open. Know what you’re signing up for. Create a lean business plan, validate your market early, and, most importantly, have a personal support system in place.

As with all things in entrepreneurship, there’s no one-size-fits-all answer. But with clarity, courage, and commitment, bootstrapping could be the decision that defines your entrepreneurial legacy.

2 Comments

Pingback: How to Navigate Complex Business Regulations: A 2025 Practical Guide for Entrepreneurs and Business Owners - Magic Media

Pingback: Business Plan Essentials: 3 Key Ingredients for Success - Magic Media